As published in print with

Brits and Europeans may be surprised to know that they are already investing in the Ugandan agricultural sector—at their breakfast tables. As Africa’s second largest coffee producer, Uganda exports nearly 75 per cent of its coffee to Europe, and over 60 per cent of its tea to the United Kingdom

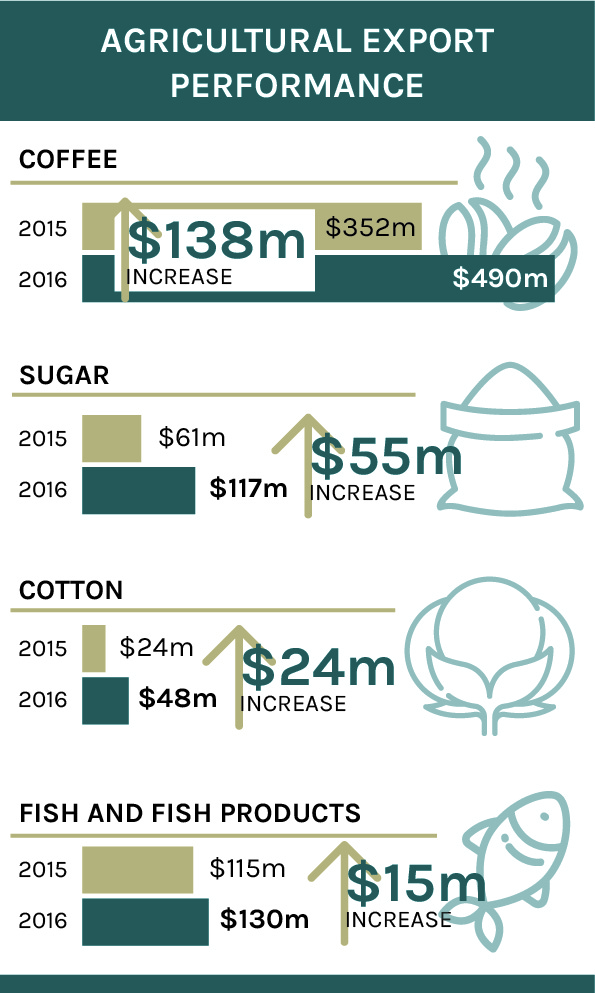

There is no doubt that agriculture is the economic powerhouse of the Ugandan economy. The sector employs roughly 75 per cent of the country’s population, contributes nearly 20 per cent of GDP, and comprises about 48 per cent of export earnings. The country’s fertile soil and tropical climate create an ideal environment for agricultural production to thrive. Coffee is Uganda’s main export, with tobacco and tea following as the top high earners. Major cash crops also include sugar, palm oil and cocoa beans.

The agricultural sector is fragmented, with small-scale farms encompassing the majority of the landscape. The Ugandan government sees the agricultural industry as a critical way to reduce poverty and empower citizens in the country. The Rural Industrialisation Project is designed to enable subsistence farmers and farming cooperatives to access agricultural inputs, assist in mechanising and increase downstream value addition to their products. Climate change is a real concern when it comes to agriculture in Uganda. In 2016, the country faced a severe drought that wiped out crops and livestock, causing food shortages and loss of income to farmers. To mitigate these effects, the government is educating farmers on conservation agriculture and helping them implement smart-farming techniques.

The Kakira Sugar factory, which produces its own energy from the by-product of sugar. Photo: Madhvani

RELATED INTERVIEW

While some cash crops, such as sugar, are consumed mostly by the domestic market, Uganda’s agricultural economy is primarily export driven. In the Ugandan export economy, coffee is king. Coffee is grown in 84 per cent of the country and exports have been on the rise, with the crop bringing in $554 million in 2017. Coffee is so important that in 2017, the government announced the Coffee Roadmap, a comprehensive plan to increase coffee production to 20 million bags by 2025. The Ugandan Coffee Development (UCDA) estimates that the industry has the potential to bring in $2 billion in revenue.

Coffee beans in a traditional basket. Photo: UCDA

In addition to sustainable farming, Ugandan farmers are also introducing new technologies to increase value across the supply chain of agricultural products. Companies like Madhvani Group use technology to create energy from an unlikely source—sugar. Increasingly technology has allowed agricultural waste to be converted into usable fuel. The only subsector currently utilising biomass residue for electricity production is the sugar industry. Madhvani Group’s Kakira Sugar uses bagasse, a fibrous by-product of sugar production, to create 51MW energy, which not only powers the entire factory, making it self-sufficient, but also contributes excess energy to the national grid. Kakira Sugar is also further refining molasses, made from sugar, into ethanol, which can be used as motor fuel.

By bringing new technologies and methods to an industry centred on the Ugandan people, government and business are able to strengthen the sector and create resilient infrastructure for the future.

The country produces premium quality beans, such as Arabica, rivalling Ethiopia’s, and Robusta, which is native to Uganda. However, currently, most of Uganda’s premium beans are blended with other coffees. UCDA’s Managing Director, Emmanuel Iyamulemye Niyibigira, says the industry is working to better brand themselves so Ugandan coffee is recognised uniquely as a premium product with a unique taste among the ranks of Colombian or Ethiopian roasts.

The good news is that coffee production and exports are on the rise. As part of the Coffee Roadmap, another government initiative, UCDA is working on increasing coffee production by encouraging farmers to switch to cultivating coffee over other crops, organising farmers to improve commercialisation, and funding research on crop resiliency. UCDA’s ambitious goal is to have 900 million coffee seedlings planted in the next three years.

Alarm bells rang in 2016 when British newspapers reported the slow decline of tea-drinkers in the United Kingdom, making the time ripe for British investors to capitalise on their compatriots’ changing palates. UCDA is looking to work with British investors to improve the value and branding of their coffee, especially for British markets. The organisation believes these investments can have profound effects on Uganda’s economic growth.